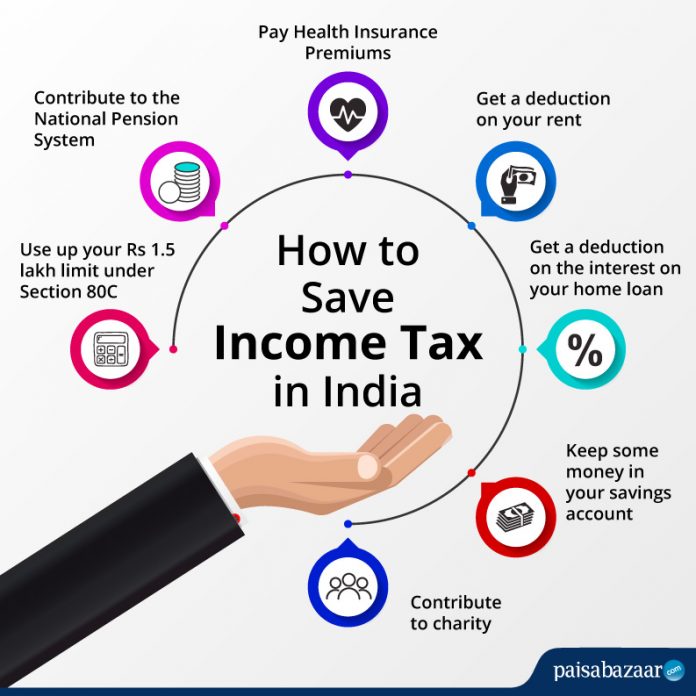

Income tax can be saved in various ways under the Income Tax Act, 1961. These include tax-saving NPS, insurance premiums, mutual funds, medical insurance and others. Here is a list of ways how which you can save income tax:

Rs 1.5 lakh limit under Section 80C- you can invest in one or combine the following:

i. Tax-Saver FDs : You can get a tax deduction of up to Rs 1.5 lakh under 5 year tax-saver FDs. There is a fixed rate of interest currently between 7-8%.

ii. PPF (Public Provident Fund): This is a scheme with a 15 year term and the interest rate is 8%. The interest on PPF is tax-free.

iii. ELSS Funds: These invest a minimum of 80% of assets in equity and have a 3 tear lock-in. The returns on ELSS funds are subject to Long Term Capital Gains Tax (LTCG) at 10%, over and above an exemption limit of Rs 1 lakh.

iv. NSC (National Saving Certificate): NSC has a tenure of 5 years and a fixed rate of interest. Now it is 8%. The NSC interest is automatically counted in the Rs 1.5 lakh 80C limit and is taxable.

v. Life Insurance Premiums: Term insurance, ULIPs and endowment policies are tax deductible up to Rs 1.5 lakh. But the insurance cover needs to be 10 times the annual premium.

vi. National Pension System (NPS): This deduction is under Section 80CCD up to Rs 1.5 lakh for contributions.

vii. Repayment of Home Loan: One can repay the principal amount and tax can be deducted up to Rs 1.5 lakh per annum.

viii. Tuition fees: Payment of tuition fees for children is tax deductible up to Rs 1.5 lakh per annum.

ix. EPF: Under the EPF Act, 12% of the pay is deducted towards Employees Provident Fund and the limit is Rs 1.5 lakh limit under Section 80C.

x. Senior Citizens Savings Scheme: Contribution to the SCSS is tax deductible up to Rs 1.5 lakh. This has a tenure of 5 years and can be availed when one is more than 60 years of age.

The ones mentioned above are a few. One can also invest in NPS, Sukanya Samriddhi Yojana, pay Health Insurance Premiums, deduction on rent/ home loan and contribute to some extent to charity.