Asia’s most exceedingly terrible performing cash took five weeks to wind up its best. The turnaround has been fueled by the improved odds of Prime Minister Narendra Modi winning a second term in the midst of ongoing strains among India and Pakistan. The idealism has prompted neighborhood offers and obligation baiting powerful streams, which have turned the convey exchange returns on the rupee to the most elevated on the planet in the previous month.

“The high-yielding rupee will probably progress further if Modi wins a second term,” said Gao Qi, a cash strategist at Scotiabank in Singapore, who anticipates that the money should rally to 67 for every dollar by June-end. A hesitant tilt by significant national banks even with a wavering worldwide extension could likewise provoke outsiders to pursue higher yields in developing Asia, he said.

Here’s a graphical take a gander at the condition of play in India’s money market:

Foreigners purchased a net $3.3 billion of offers through March 18, representing the greater part the $5.6 billion of inflows year-to-date, and raised possessions of securities by $1.4 billion this month. The spout of dollars sent the rupee to its most elevated amount since August, provoking benefit booking that saw the cash posting its first drop in seven sessions on Tuesday.

Getting in dollars to buy rupee resources has earned 3.8 percent in the course of the last one month, the best convey exchange return on the planet, information arranged by Bloomberg appear. Two assessment surveys demonstrated Modi’s decision alliance may draw near to the 272 seats required for lion’s share in races that start on April 11. Results are expected on May 23.

“The market is evaluating in a Modi triumph as there are no different elements that clarify the unexpected difference in state of mind,” said Anindya Banerjee, an investigator at Kotak Securities Ltd. in Mumbai. “In addition, convey dealers are anxious to be long rupee and short other low-yielding monetary forms, including the dollar. It is a get-set-go for the rupee.”The rupee good faith is likewise reflected in the subordinates showcase, where one-month choices presenting the privilege to sell the rupee currently cost 19 premise guides more than those toward purchase. That is down from 148 on Sept. 5, which was the most elevated since November 2016.

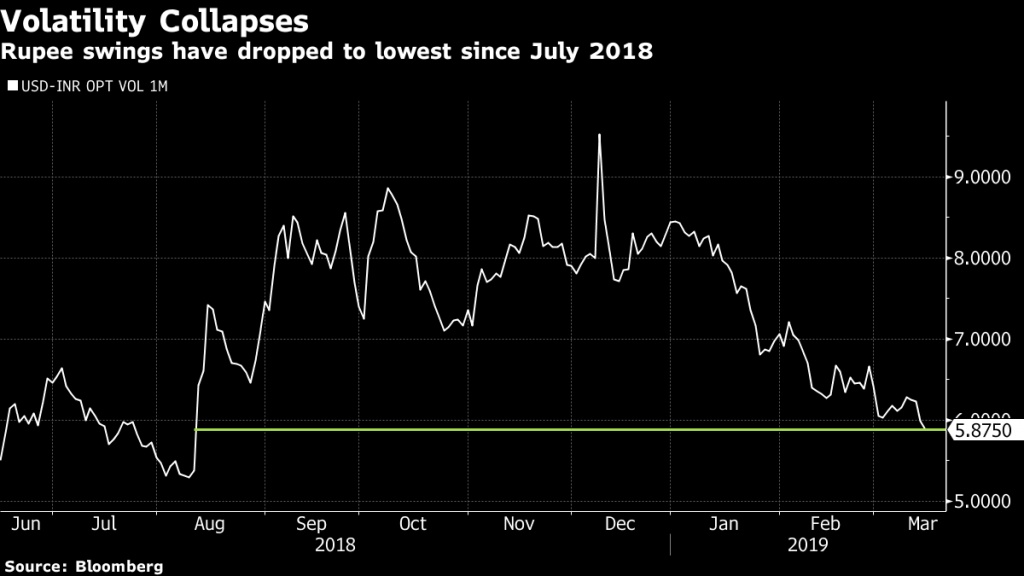

“Worldwide conditions – tentative Fed and ECB – have turned progressively steady and locally, expanded trust in the BJP’s prospects and a recuperation in portfolio streams have been the key driver” for the rupee, said Dushyant Padmanabhan, a money strategist at Nomura Holdings Inc. in Singapore.The rupee’s three-month suggested unpredictability, a measure of expected swings used to value choices, tumbled to 5.87 percent on Friday, the most reduced perusing since August.

“We anticipate that the rupee should stay versatile in the close term, as packed up outside inflows limit any weight from debilitating EMFX estimation,” Barclays Plc strategist Ashish Agrawal, wrote in a note. “A potential BJP-drove alliance triumph would look good for the INR for whatever is left of this current year.”