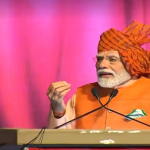

Prime Minister Narendra Modi will take a final call on income tax rate cuts

Nirmala Sitharaman may raise the minimum exemption limit from the current ₹2.5 lakh

As the clamour grows for more money into the pockets of consumers and households to boost consumption in the economy, the government is discussing multiple options on cuts in personal income tax in the forthcoming Union Budget.

A final decision on personal income tax cuts will be taken by Prime Minister Narendra Modi in the next few days.

The options being considered by the Finance Ministry include acting on suggestions of task force on direct tax simplification.

A tweaking of tax slabs is on also on the agenda and as part of the restructuring the government may raise the minimum exemption limit from the current ₹2.5 lakh.

Among the measures being considered include increasing tax saving measures through various options. Sources say the government is also considering tax saving options through infrastructure bonds. Under this window, tax saving may be allowed via infra bonds of up to ₹50,000 a year.

The panel on direct taxes code (DTC) has suggested the widening of the income tax slabs. It has suggested that the 10% tax slab should be extended up to ₹10 lakh, which will bring a significant relief to a large chunk of taxpayers.

Between ₹10-20 lakh, the tax slab is pegged at 20 per cent while from ₹20 lakh to ₹2 crore it is 30 per cent and beyond ₹2 crore it is 35 per cent.

If these recommendations are approved, approximately 1.47 crore taxpayers would move from the 20% slab to the 10% slab. The task force has retained the basic exemption level at ₹2.5 lakh for general income taxpayers.

As per the Budget 2019 announcement, no changes in the income tax slabs and rates had been proposed. A rebate of ₹12,500 was made available for all taxpayers with taxable income up to ₹5 lakh. The standard deduction for financial year 2019-20 was kept at ₹50,000.