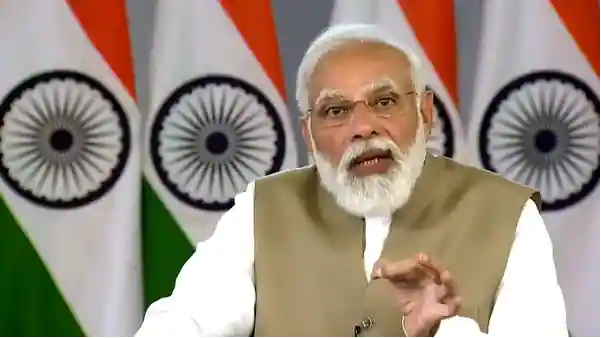

Prime Minister Narendra Modi on Friday launched two customer-centric initiatives of the Reserve Bank of India (RBI)- the RBI Retail Direct Scheme and the Reserve Bank – Integrated Ombudsman Scheme. During the virtual launch of the scheme, RBI Governor Shaktikanta Das was also present.

“RBI has been leveraging technology & innovation for enhancing the efficiency of it services. RBI’s developmental role is focused on further deepening of financial inclusion and undertaking people centric initiatives”, Das said during the launch of the two schemes.

RBI Retail direct Scheme

Through this scheme, a retail investor will get access to the government securities market. This scheme offers a new avenue for directly investing in securities issued by both Centre and state governments. “Investors will be able to easily open and maintain their government securities account online with the RBI, free of cost,” the Prime Minister’s Office said in a statement.

RBI Integrated Ombudsman Scheme

This will help in improving the grievance redress mechanism for resolving customer complaints against RBI’s regulated entities. According to the PMO, the scheme is based on ‘One Nation-One Ombudsman’ with one portal, one email, and one address for the customers to lodge their complaints.

The bank customers will be able to file complaints, submit documents, track status, and give feedback through a single email address. There will also be a multi-lingual toll-free number that will provide all relevant information on grievance redress.

Now, there will be a single point of reference for customers to file their complaints, submit the documents, track status, and provide feedback. Under this scheme, there will be a multi-lingual toll-free number will provide all relevant information on grievance redress and assistance for filing complaints. The redressal will continue to be cost-free for customers of banks and members of the public.